Need precise and reliable valuation services? ✨

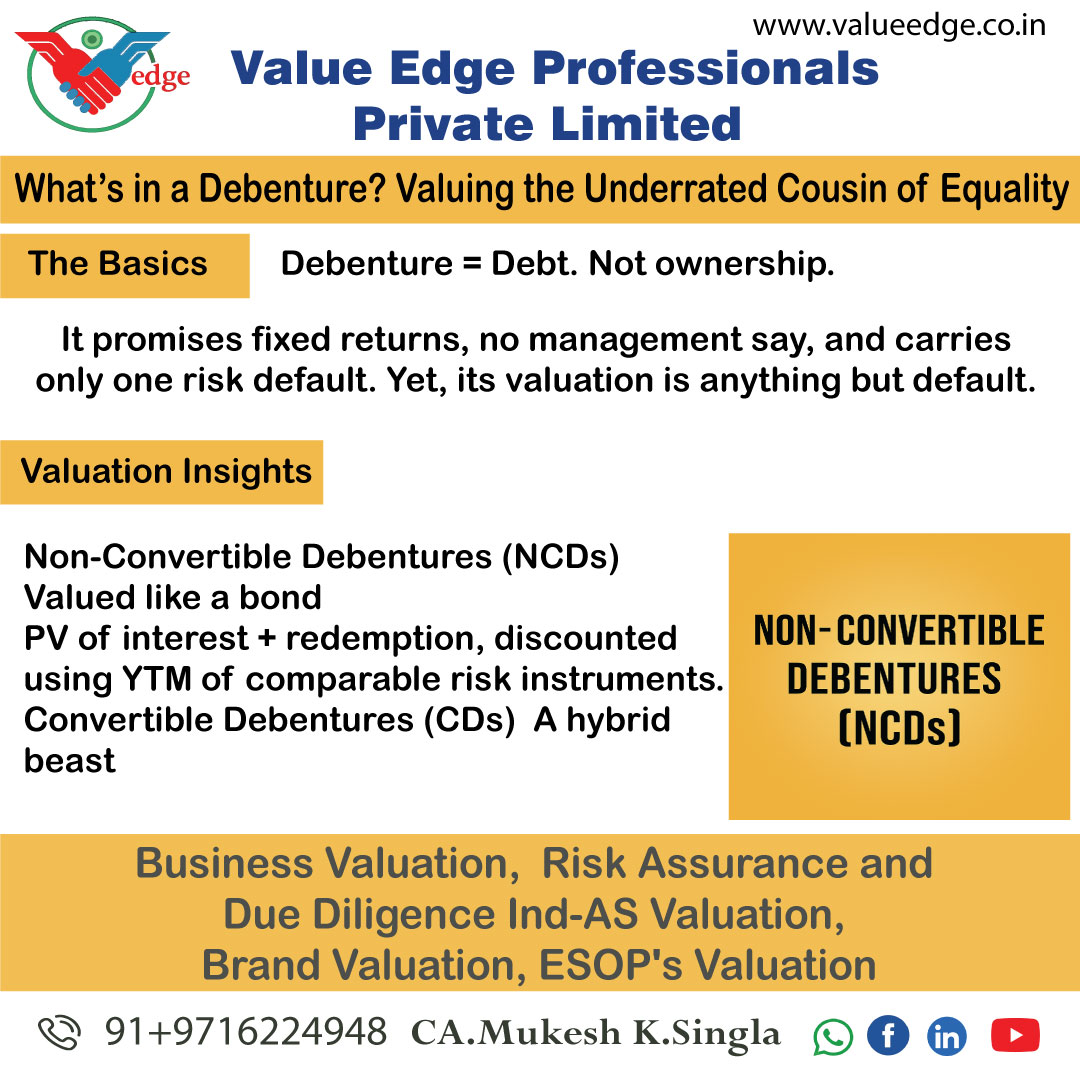

What’s in a Debenture? Valuing the Underrated Cousin of Equity

Equity often gets the limelight, but debentures quiet, structured, and contractual carry their own valuation complexities that deserve attention.

The Basics

Debenture = Debt. Not ownership.

It promises fixed returns, no management say, and carries only one risk: default. Yet, its valuation is anything but default.

Valuation Insights

Non-Convertible Debentures (NCDs) → Valued like a bond

PV of interest + redemption, discounted using YTM of comparable risk instruments.

Convertible Debentures (CDs) → A hybrid beast

Pre-conversion = debt

Post-conversion = equity

Valued using option pricing or split valuation (Ve + Vd).

Demi-Proxy Approach

Sometimes, valuers use equity valuation as a benchmark—especially for regulatory thresholds under FEMA, Companies Act, and Income Tax.

Why It Matters

Whether you’re pricing CCDs in a startup deal or issuing OCDs under Section 62(1)(c), ignoring the nuances can mean mispricing risk, misreporting fair value, or non-compliance.

Takeaway for Valuers & Dealmakers:

Debentures may be debt on paper—but their valuation often demands equity-level analysis.

Because in valuation, form follows function—but value follows substance.

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.