Need precise and reliable valuation services? ✨

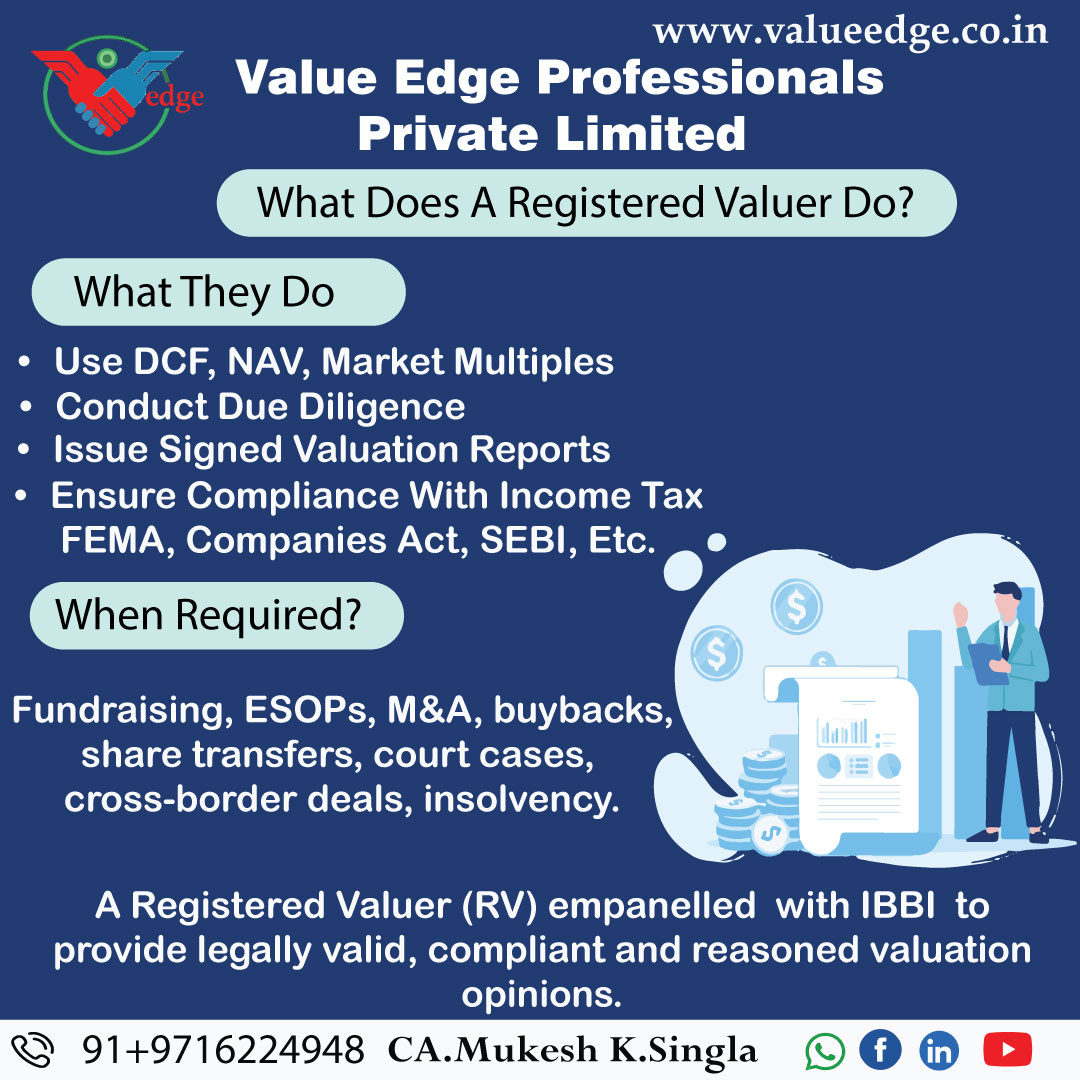

What Does a Registered Valuer Actually Do?

“Why do we need a Registered Valuer?”

Because valuation isn’t just math it’s a regulated opinion grounded in law, logic, and accountability.

Who is a Registered Valuer (RV)?

A professional recognized under Section 247 of the Companies Act, 2013, empanelled with the IBBI (Insolvency and Bankruptcy Board of India) to determine the fair value of assets.

They are certified to value:

Securities or Financial Assets

Plant & Machinery

Land & Building

What does an RV do?

Applies valuation methodologies (DCF, NAV, Market Approach)

Conducts due diligence on business, legal, and financial records

Drafts legally compliant valuation reports

Ensures alignment with Income Tax Act, FEMA, Companies Act, SEBI, etc.

Stands by their opinion with personal professional liability

When is a Registered Valuer required?

Fundraising / ESOPs (Sec. 62, 56(2)(viib))

Mergers / Demergers (Sec. 232)

Share transfers / Buybacks

Family settlements / Court cases

Cross-border deals (FEMA compliance, 409A, FDI pricing)

Insolvency, liquidation & restructuring

Why it matters:

In the eyes of regulators, a valuation is valid only if issued by an eligible professional and RVs are trained, tested, and regulated for this exact role.

“A Registered Valuer is not just a number-giver.

They are a bridge between compliance and commercial logic.”

Next up: Startup Valuation with No Revenue Art or Science?

#ValuationDecoded #RegisteredValuer #IBBI #CompaniesAct #Fundraising #ValuationReport #ESOP #FEMA #BusinessValuation

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.