Need precise and reliable valuation services? ✨

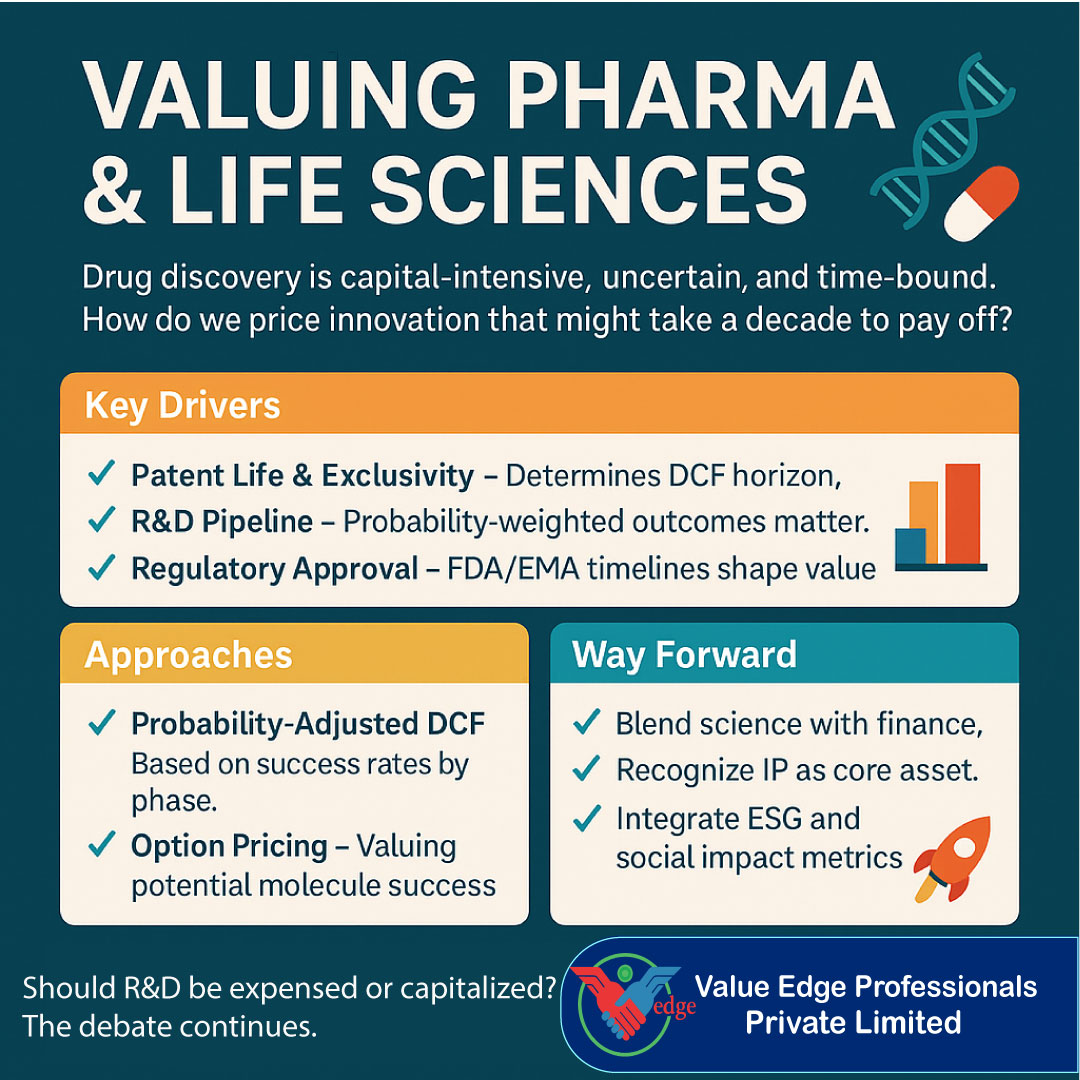

Valuing Pharma & Life Sciences

Drug discovery is capital-intensive, uncertain, and time-bound. How do we price innovation that might take a decade to pay off?

Key Drivers

Patent Life & Exclusivity – Determines DCF horizon.

R&D Pipeline – Probability-weighted outcomes matter.

Regulatory Approval – FDA/EMA timelines shape value.

Approaches

Probability-Adjusted DCF – Based on success rates by phase.

Option Pricing – Valuing potential molecule success.

Market Comparables – Benchmarking biotech peers.

Way Forward:

Blend science with finance.

Recognize IP as core asset.

Integrate ESG and social impact metrics.

Should R&D be expensed or capitalized? The debate continues.

pharmaValuation #LifeSciences #IntangibleAssets #BusinessValuation

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.