Need precise and reliable valuation services? ✨

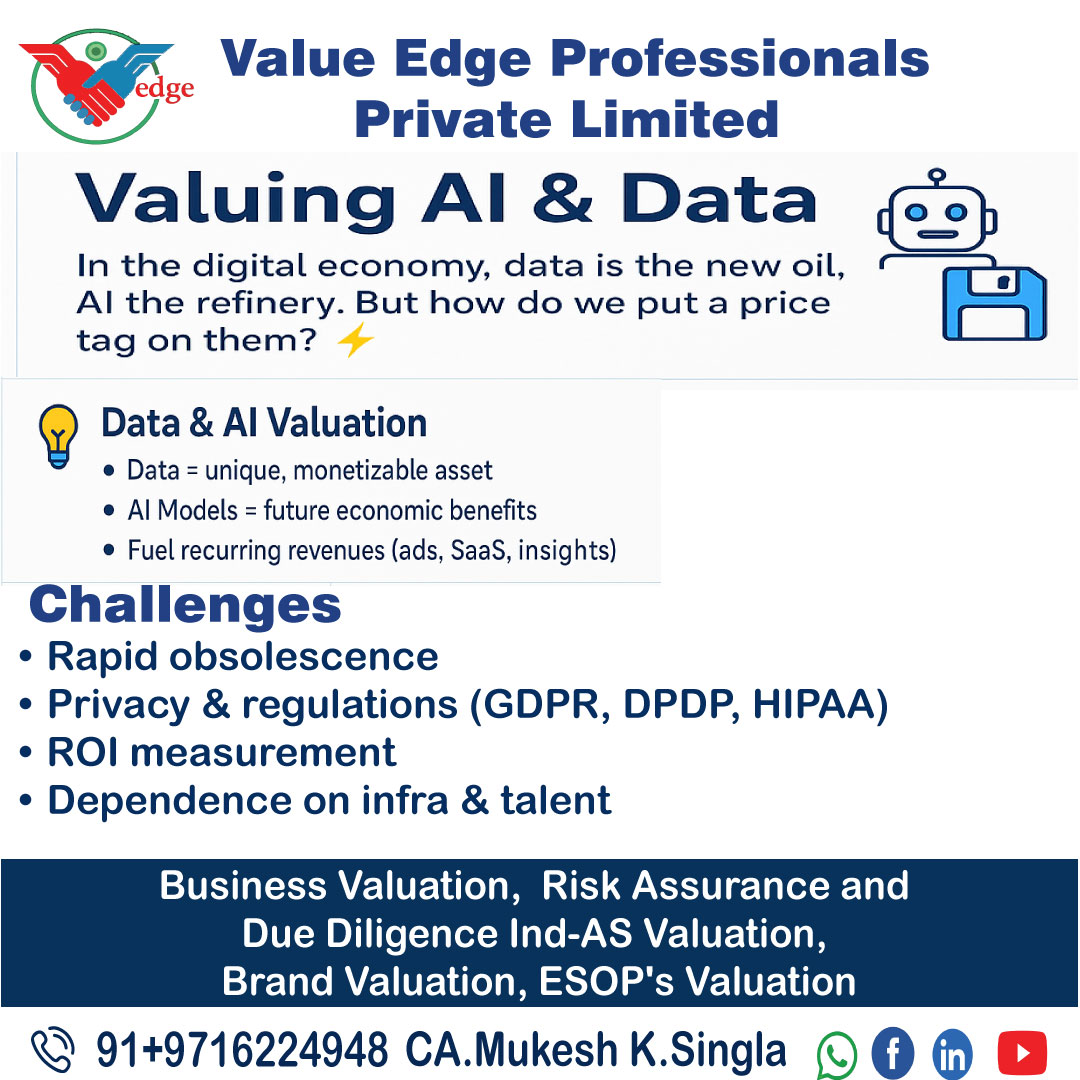

Valuing AI & Data as an Asset

In today’s digital economy, data is the new oil and AI is the new refinery. But how do we assign value to datasets and AI models that power billion-dollar companies? Let’s explore! ?

What is Data & AI Valuation?

Data as an Asset – Unique datasets (user behavior, medical records, proprietary algorithms) hold immense value.

AI Models – Trained machine learning models create future economic benefits, qualifying as intangible assets.

Monetization Potential – From targeted ads to predictive analytics, data and AI fuel recurring revenue streams.

Challenges in Valuing Data & AI

Rapid Obsolescence Data loses relevance quickly without constant updates.

Privacy & Regulation GDPR, DPDP Act, HIPAA, etc. impact monetization.

Measurement Difficulty Hard to estimate ROI of data-driven insights.

Dependence on Tech AI value linked to computing infrastructure and talent.

Common Valuation Approaches

Cost Approach Value = cost to collect, clean, and process the data.

Market Approach Benchmarking with data licensing deals.

Income Approach Discounted cash flows from monetization (ads, SaaS, insights).

Way Forward:

Recognize data/AI as intangible assets in financial statements.

Adopt hybrid valuation models combining cost + income approaches.

Track regulatory trends shaping future monetization.

What’s your take Should companies disclose “Data Assets” in their balance sheets?

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.