Need precise and reliable valuation services? ✨

Valuing a SaaS Company with 5 Cr ARR

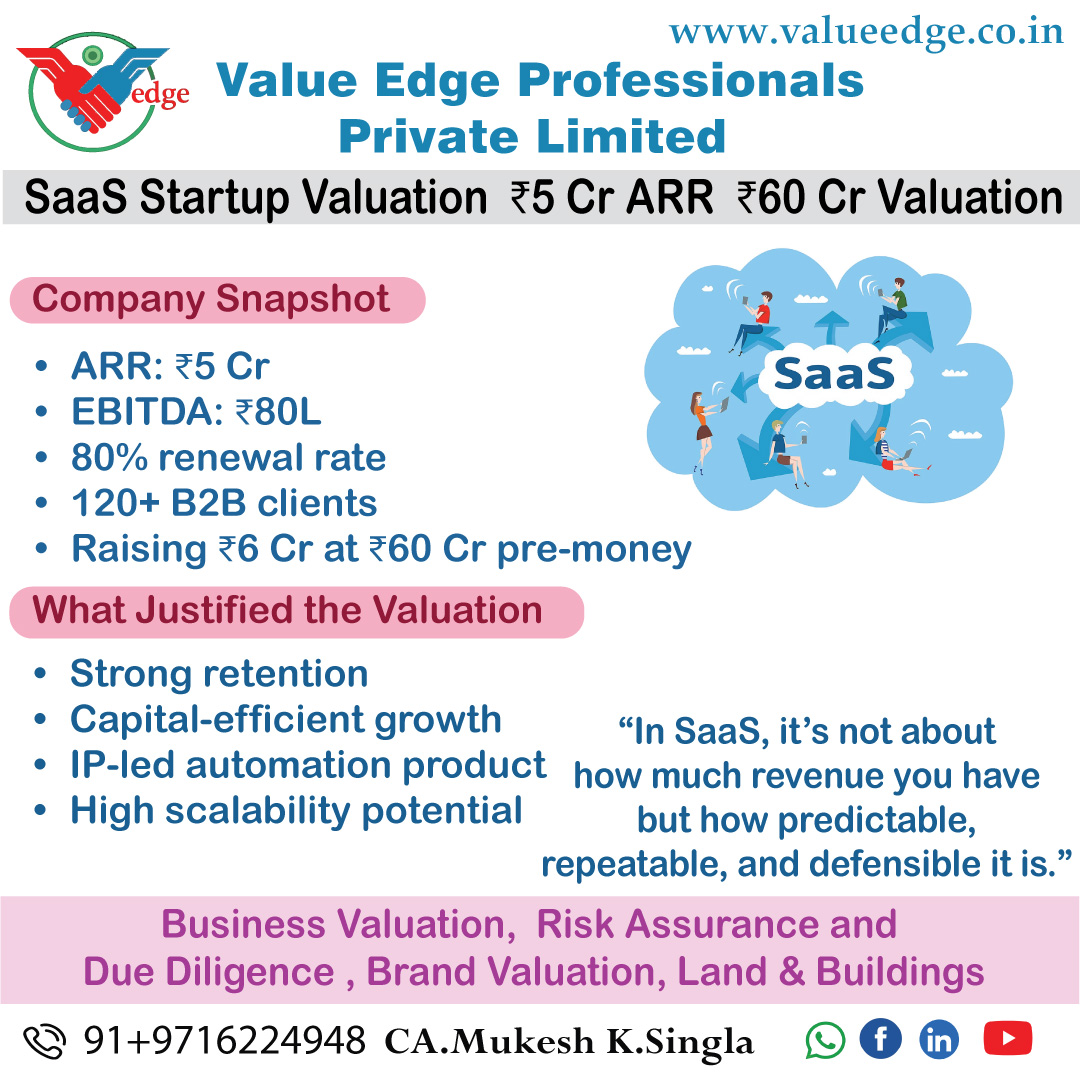

In SaaS, valuation is not about today’s profits it’s about recurring revenue, customer stickiness, and scalability.

Let’s look at how we valued a growing B2B SaaS startup generating 5 Cr in ARR.

Company Snapshot:

Valuation Approaches Applied:

1 Revenue Multiple (ARR-based)

2 EBITDA Multiple (Secondary Cross-check)

3 VC Method (Exit-Based)

Why the ?60 Cr Pre-Money Was Justified:

Strong retention + growth + scalable infra

SaaS has high capital efficiency

Market demand + IP-driven moat

Valuation driven by revenue quality, not just quantity

Takeaway:

“In SaaS, 5 Cr revenue can fetch 50–60 Cr in valuation if your revenue is sticky, scalable, and growing.”

Next Up: Why NAV Sometimes Outranks DCF – Real Estate Holding Case

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.