Need precise and reliable valuation services? ✨

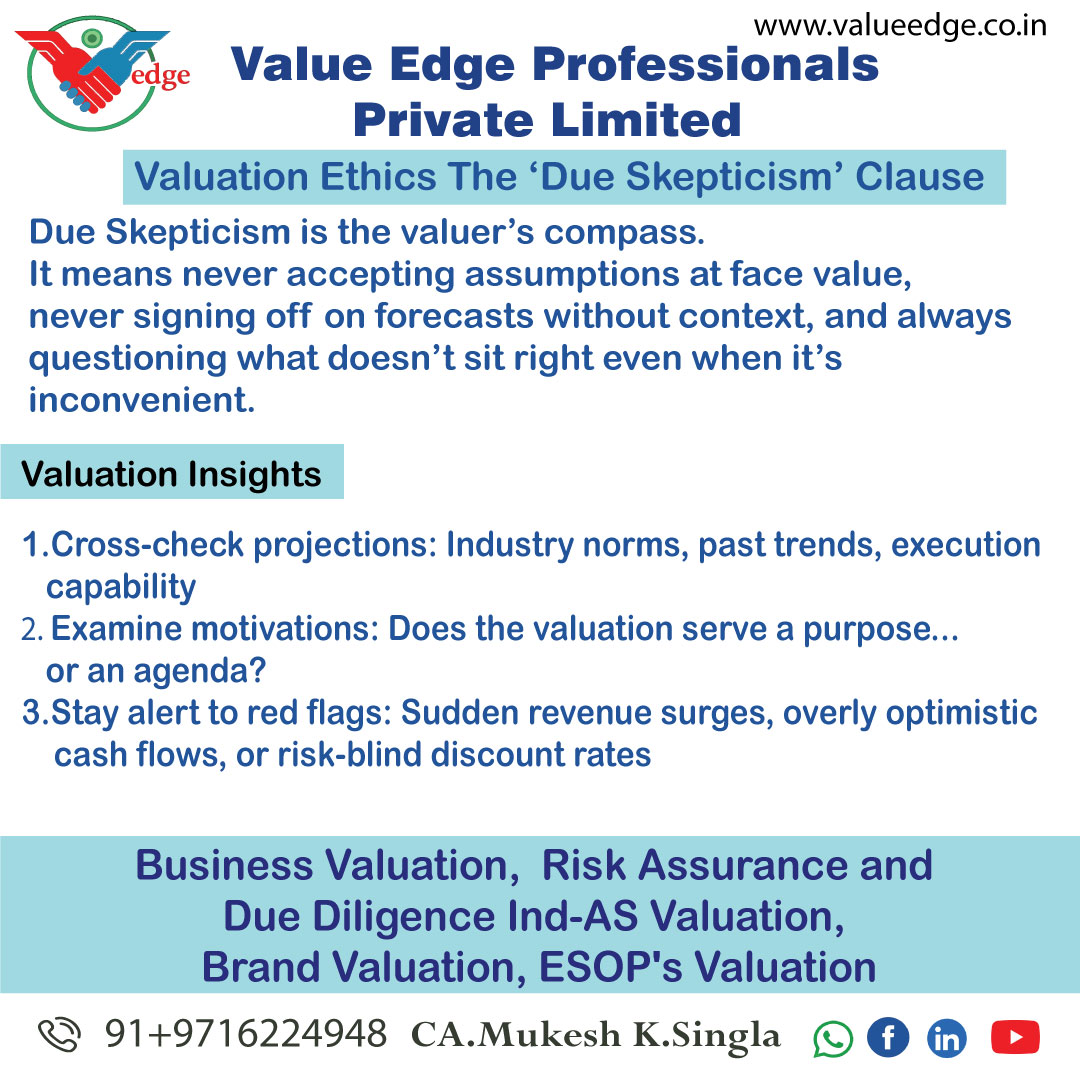

Valuation Ethics: The ‘Due Skepticism’ Clause

In valuation, numbers may dazzle but it’s judgment that defines integrity.

At the heart of this integrity lies a principle professionals often overlook: Due Skepticism.

?? The Core Ethic

It’s not just about what you’re given

It’s about how critically you assess it.

Due Skepticism is the valuer’s compass. It means never accepting assumptions at face value, never signing off on forecasts without context, and always questioning what doesn’t sit right even when it’s inconvenient.

Valuation Insights

Cross-check projections: Industry norms, past trends, execution capability

Examine motivations: Does the valuation serve a purpose... or an agenda?

Stay alert to red flags: Sudden revenue surges, overly optimistic cash flows, or risk-blind discount rates

Ethical Missteps to Avoid

Blind reliance on client-provided data

Ignoring inconsistencies just to "keep the peace"

Rushing judgment due to deadlines or pressure from stakeholders

Takeaway for Valuers & Analysts:

Due Skepticism isn’t doubt for doubt’s sake. It’s the foundation of professional integrity.

It’s what makes the difference between a credible report and a compromised one.

Be curious. Be cautious. Be courageous.

Because trust in your work begins with doubt in what you’re given.

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.