Need precise and reliable valuation services? ✨

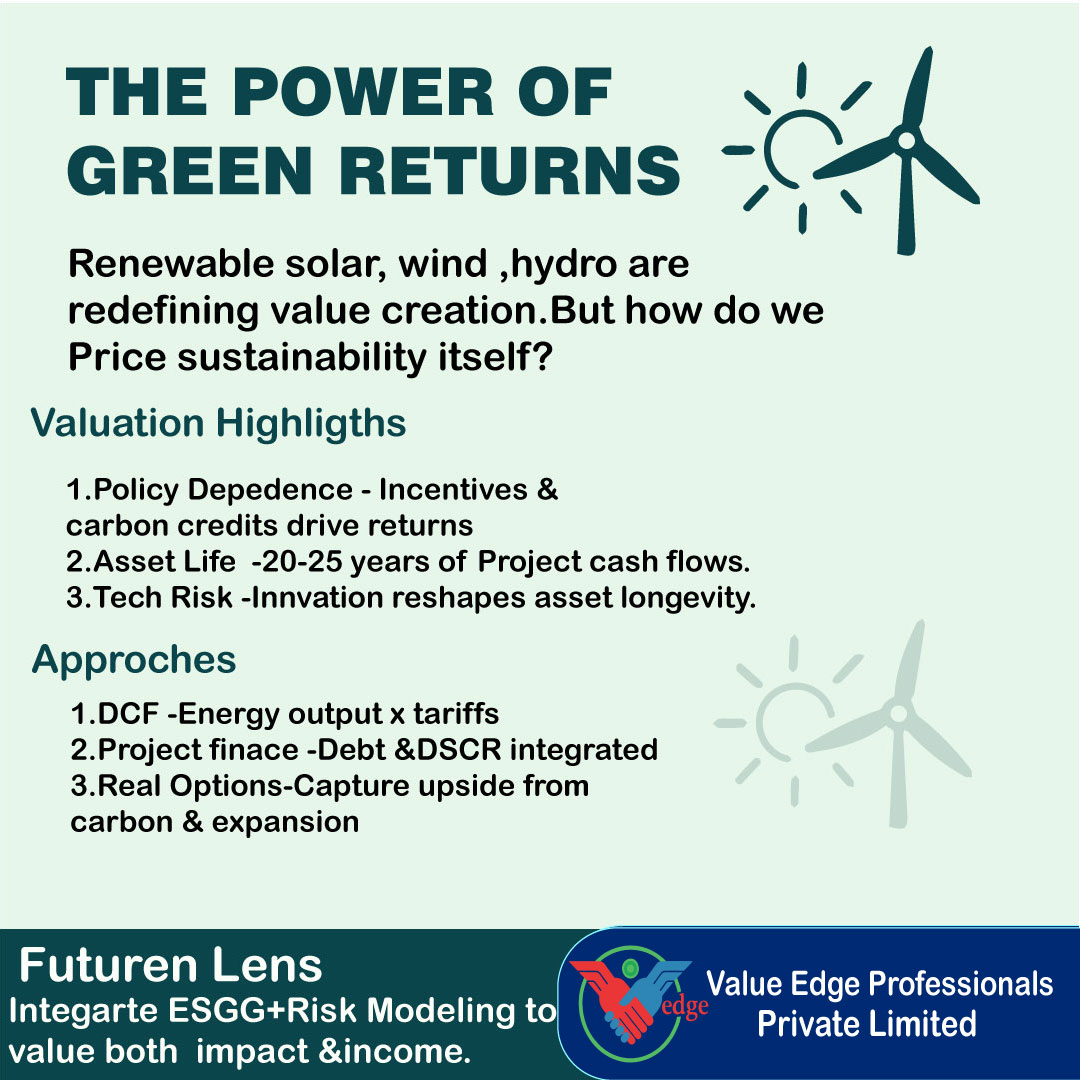

The Power of Green Returns

As the world moves toward sustainability, renewable energy assets solar, wind, hydro are becoming valuation frontiers. But how do we value something driven by carbon credits, subsidies, and long-term PPAs?

Key Considerations

Policy Dependence – Tariffs, incentives, and carbon credits shape cash flows.

Asset Life – 20–25 year project horizons need robust discounting.

Technology Risk – Rapid innovation can impact long-term viability.

Valuation Approaches

DCF Approach – Based on projected electricity generation and tariffs.

Project Finance Valuation – Incorporating leverage and debt service coverage.

Real Options – Capturing upside from future expansions or carbon trading.

Way Forward:

Integrate ESG metrics in valuation models.

Model regulatory and weather uncertainty.

Recognize the growing role of green bonds & investors.

How do you value green energy asset, impact, or both?

#ValuationSeries #RenewableEnergy #GreenFinance #ESG #BusinessValuation #Sustainability

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.