Need precise and reliable valuation services? ✨

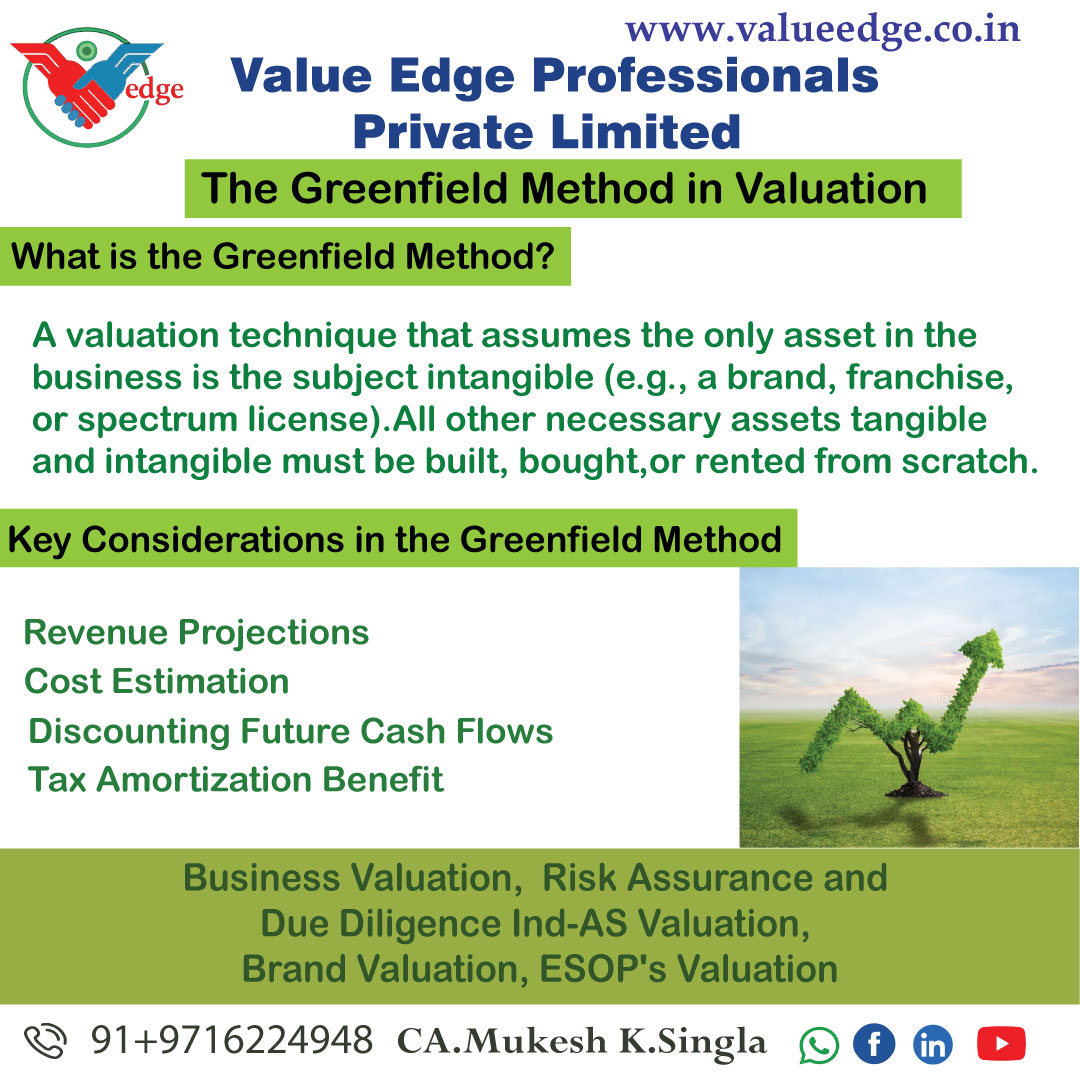

The Greenfield Method in Valuation.

Valuing intangible assets requires specialized approaches, and one such technique is the Greenfield Method. But what is it, and when should it be used? Let’s explore!

What is the Greenfield Method?

A valuation technique that assumes the only asset in the business is the subject intangible (e.g., a brand, franchise, or spectrum license).

All other necessary assets—tangible and intangible—must be built, bought, or rented from scratch.

Key Considerations in the Greenfield Method

Revenue Projections – Forecasting income as if starting the business from zero.

Cost Estimation – Factoring in the cost of acquiring essential assets (e.g., infrastructure, human capital).

Discounting Future Cash Flows – Applying an appropriate discount rate to determine present value.

Tax Amortization Benefit (TAB) – Adjusting for tax-related benefits if applicable.

Valuation Approaches Using the Greenfield Method

Franchise Valuation – Used to estimate the worth of a franchise model.

Broadcast Spectrum Valuation – Applied in telecom for valuing spectrum licenses.

Infrastructure Asset Valuation – Assessing the value of assets that require substantial capital investment.

Way Forward:

The Greenfield Method isolates the true economic contribution of an intangible asset.

Useful when a business heavily depends on a single intangible asset.

Requires detailed financial modeling and expert judgment for accurate valuation.

What’s your take on the Greenfield Method? Let’s discuss!

#GreenfieldMethod #BusinessValuation #IntangibleAssets #Finance #ValuationApproach #DCF #FranchiseValuation #Investment

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.