Need precise and reliable valuation services? ✨

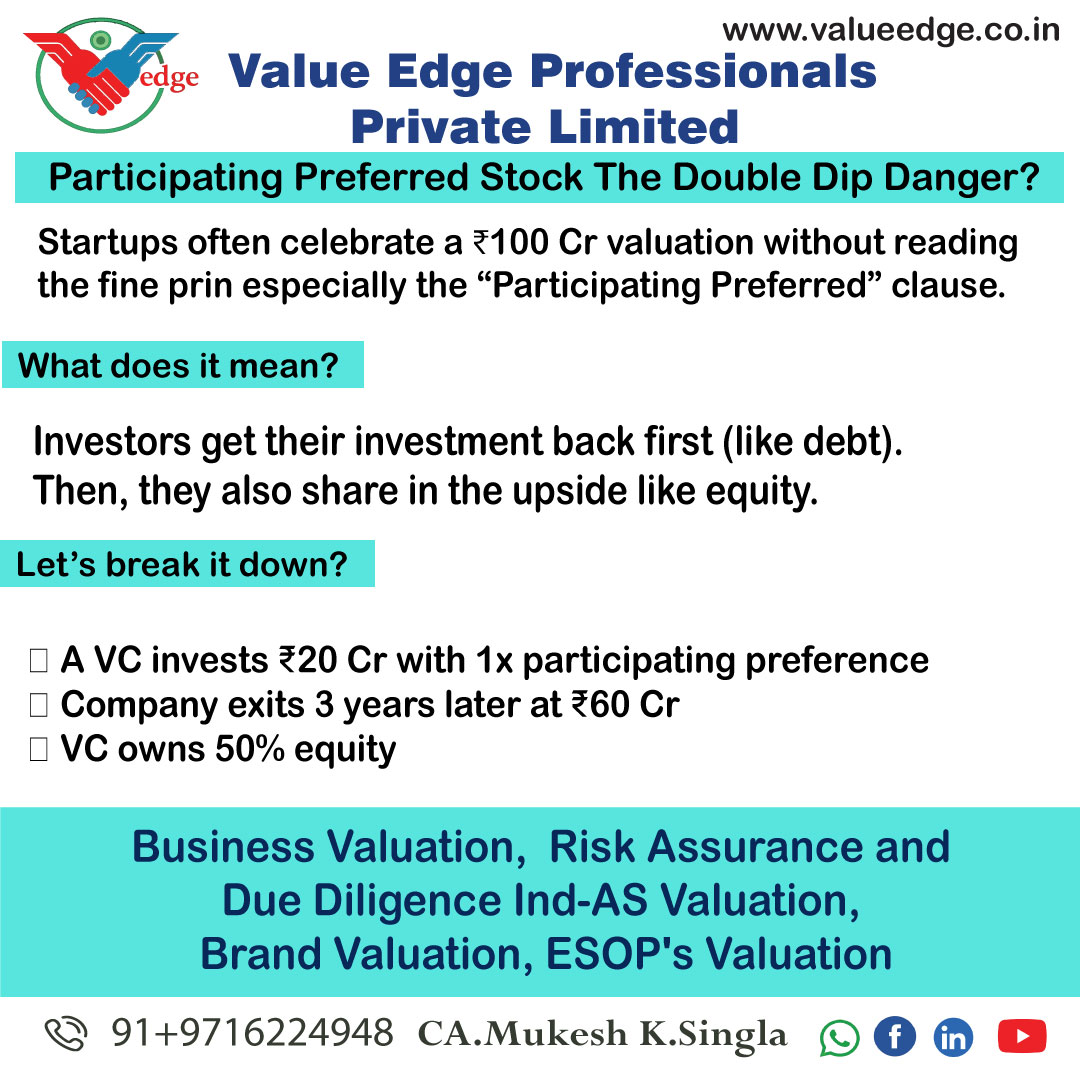

Participating Preferred Stock: The Double Dip Danger

Startups often celebrate a ?100 Cr valuation without reading the fine print — especially the “Participating Preferred” clause.

What does it mean?

Investors get their investment back first (like debt).

Then, they also share in the upside — like equity.

Let’s break it down:

A VC invests ?20 Cr with 1x participating preference

Company exits 3 years later at ?60 Cr

VC owns 50% equity

Here’s the Waterfall:

1? VC gets ?20 Cr back (initial capital)

2? Remaining ?40 Cr is split 50-50

VC gets another ?20 Cr

Founders get ?20 Cr

Final Outcome:

VC walks away with ?40 Cr

Founders & team split just ?20 Cr — despite building the company

Without Participation?

VC gets ?30 Cr (50% equity share)

Founders walk away with ?30 Cr

Lesson for Founders, CFOs & Valuers:

Participating Preferred = "Debt + Equity" in one instrument

Look beyond valuation — terms matter more

Negotiate for non-participating preferred or cap participation

Because in startup funding, participation preferences can silently rob the upside.

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.