Need precise and reliable valuation services? ✨

Market Multiples Method The Art of Choosing the Right Comparable

When the market speaks, this method listens.

The Market Multiples (or Comparable Company Analysis) method values a business based on how similar companies are priced in the market.

It’s quick, intuitive, and widely accepted but only if comparables are carefully chosen.

What is the Market Multiples Method?

It estimates business value using valuation ratios of comparable companies.

Common multiples:

How it works (simplified):

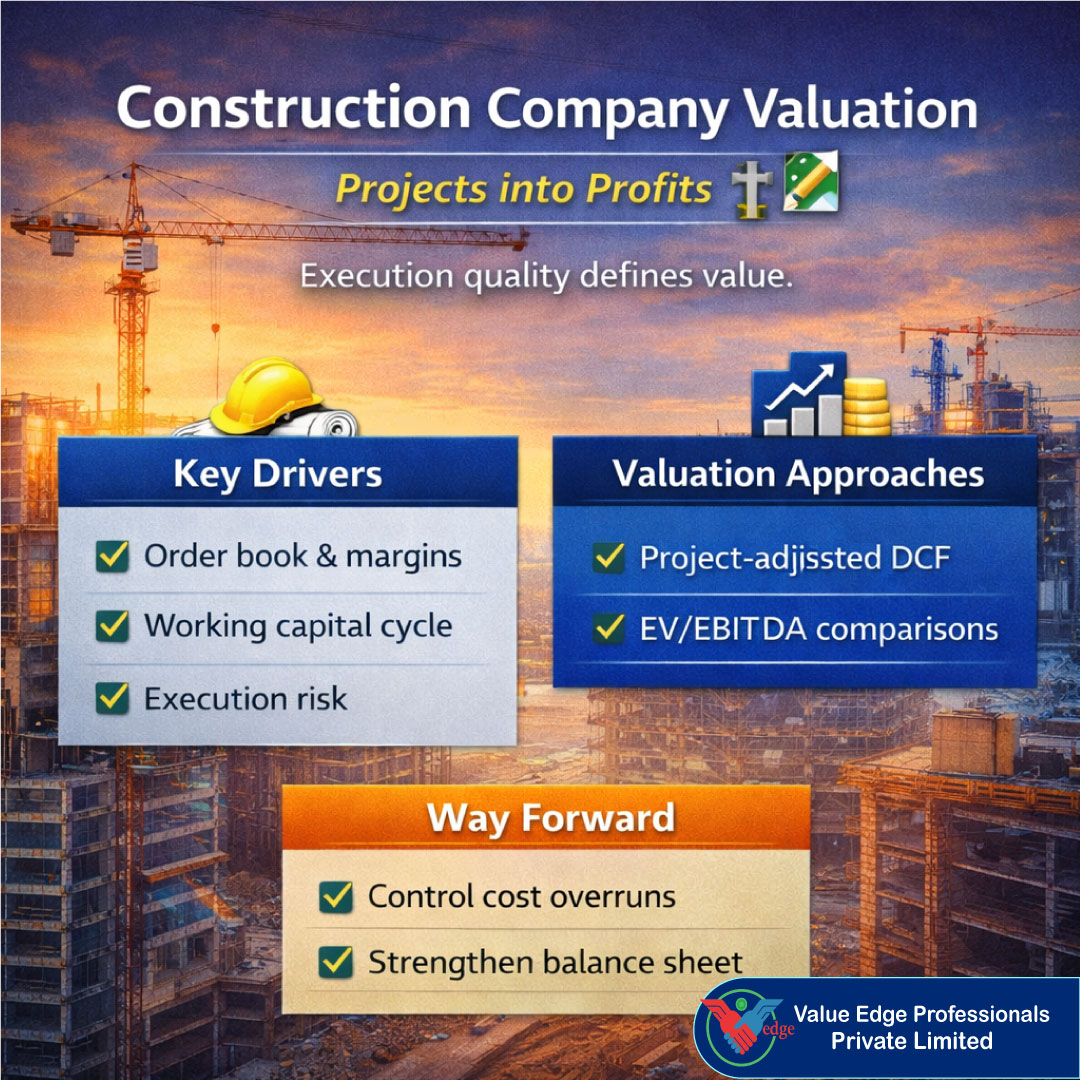

Enterprise Value = EBITDA × EV/EBITDA multiple

or

Equity Value = PAT × P/E multiple

Once enterprise or equity value is computed, divide by no. of shares to get per share value.

Key to accuracy? Choosing the right peer set:

Industry & business model match

Similar scale of operations

Growth trajectory & profitability

Geography (local vs global comps)

Recent transaction comparables (if public data isn't available)

When to Use Market Multiples:

Why it works:

“Multiples simplify value but only when backed by sound comparables.”

Next Up: Valuing a Startup with No Revenues Is That Even Possible?

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.