Need precise and reliable valuation services? ✨

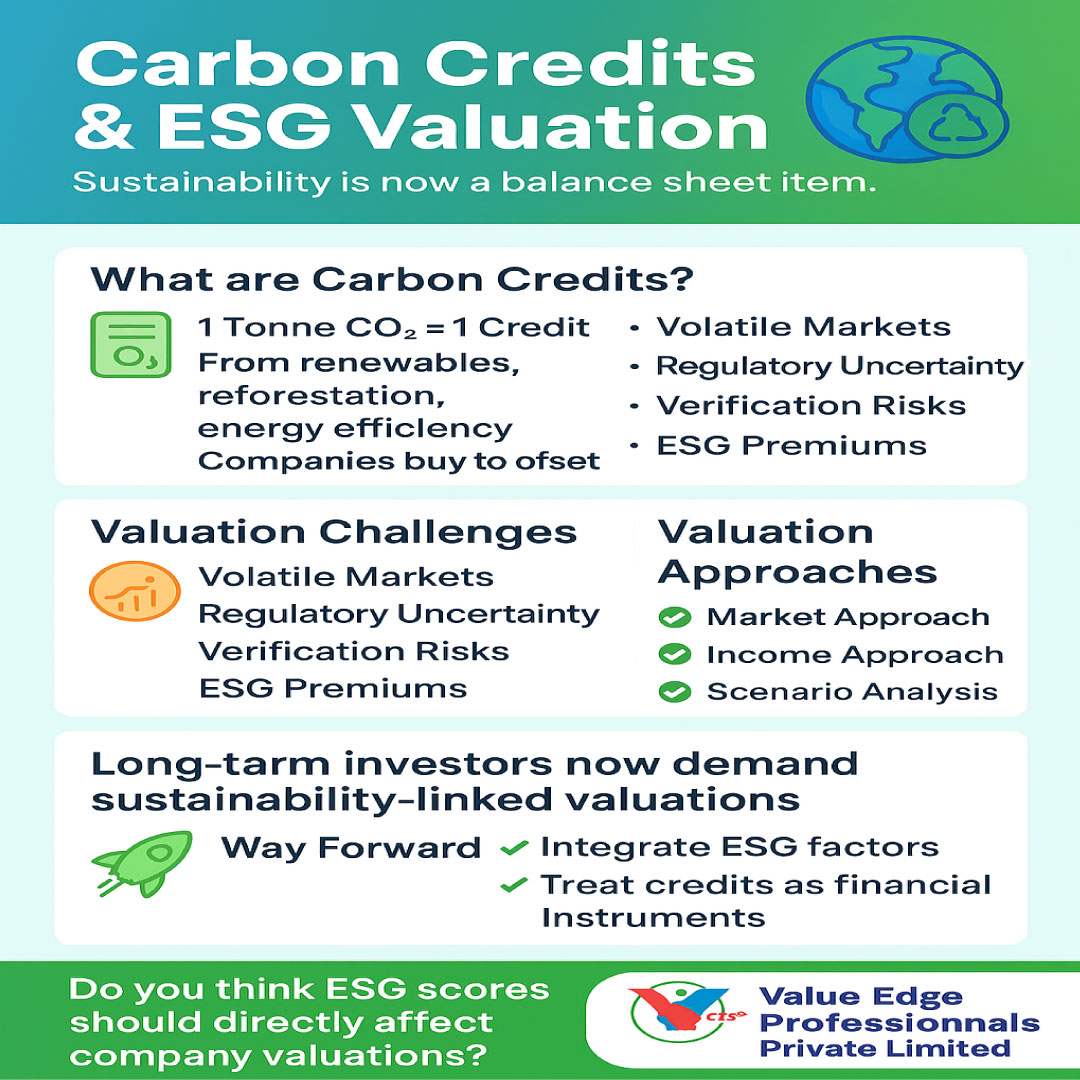

Carbon Credits & ESG Valuation

Sustainability isn’t just a buzzword anymore it’s a balance sheet item. Carbon credits and ESG scores are now shaping valuations globally.

What are Carbon Credits?

Tradable certificates representing one tonne of CO2 emission reduction.

Created via green projects (renewables, reforestation, energy efficiency).

Bought by companies to offset emissions.

Valuation Challenges

Volatile Markets Prices vary across geographies & exchanges.

Regulatory Uncertainty Different rules (EU ETS, India’s CCTS).

Verification Risks Quality and credibility of credits.

ESG Premiums Higher ESG scores = lower cost of capital.

Valuation Approaches

Market Approach Benchmarking carbon credit trading prices.

Income Approach Future savings/earnings from ESG initiatives.

Scenario Analysis Accounting for policy and climate risks.

Way Forward:

Integrate ESG factors in traditional valuation models.

Treat carbon credits as financial instruments, not side benefits.

Long-term investors now demand sustainability-linked valuations.

Do you think ESG scores should directly affect company valuations?

#ValuationSeries #CarbonCredits #ESGValuation #Sustainability #BusinessValuation #GreenFinance #ClimateChange

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.