Need precise and reliable valuation services? ✨

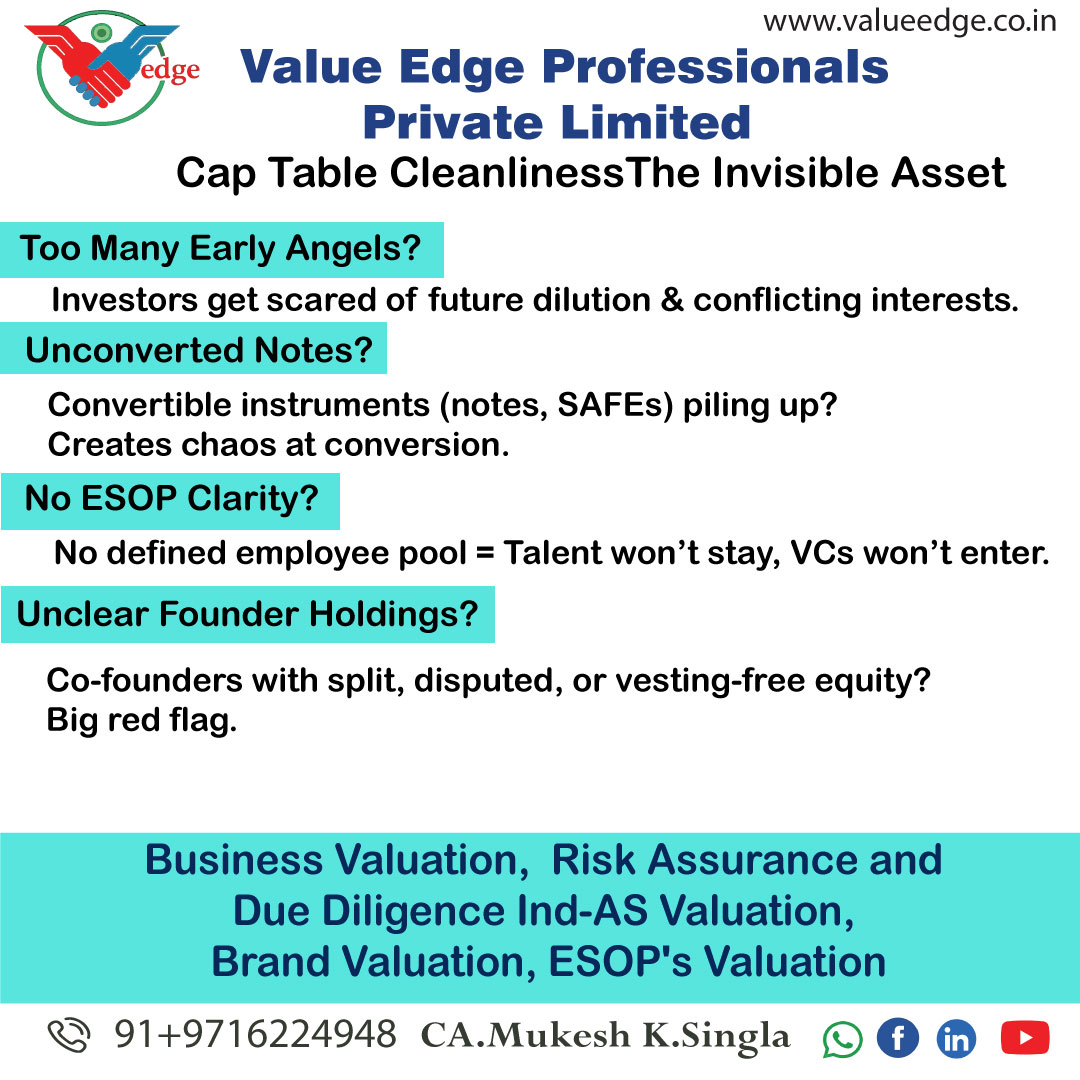

Cap Table Cleanliness: The Invisible Asset

When startups chase valuation and capital without structure the cap table starts looking like a jigsaw puzzle.

A messy cap table can quietly kill your future funding. Here’s how:

Too Many Early Angels?

Investors get scared of future dilution & conflicting interests.

Unconverted Notes?

Convertible instruments (notes, SAFEs) piling up? Creates chaos at conversion.

No ESOP Clarity?

No defined employee pool = Talent won’t stay, VCs won’t enter.

Unclear Founder Holdings?

Co-founders with split, disputed, or vesting-free equity? Big red flag.

The Real Risk:

Messy cap tables complicate due diligence, delay deals, and reduce valuations.

What Founders & Valuers Must Do:

Maintain clear records from Day 1

Convert all notes before raising VC rounds

Cap table ≠ just equity include options, convertibles, warrants

Use clean digital tools (AngelList, Carta, etc.)

Because in startup funding,

A clean cap table is as valuable as the product itself.

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.