Need precise and reliable valuation services? ✨

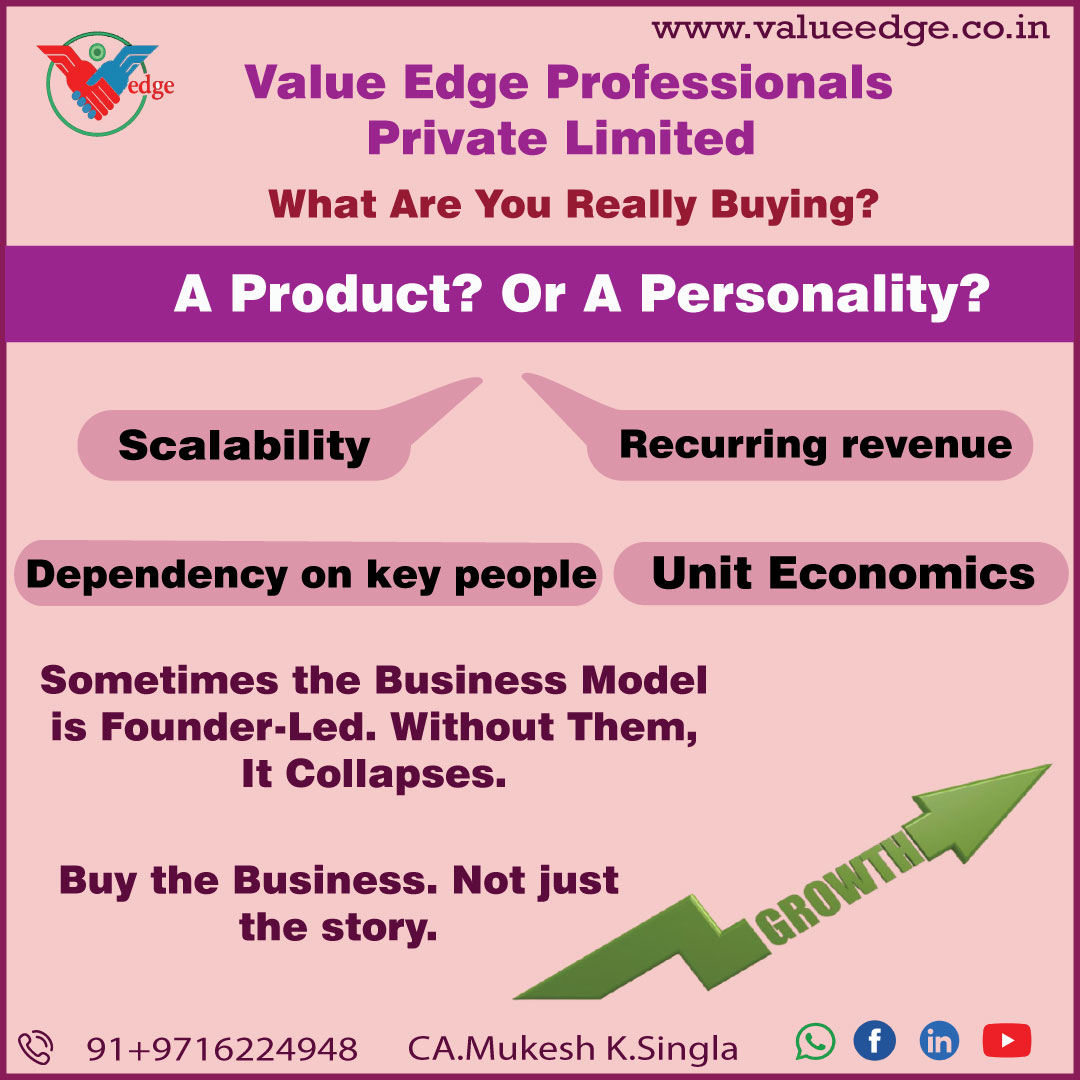

Business Model Check – What Are You Really Buying?

Title: A Product? Or a Personality?

Sometimes the business model is founder-led. Without them, it collapses.

We evaluate:

Buy the business. Not just the story.

In many early-stage ventures, the founder is the engine - driving product, sales, even customer delight.

But as an investor or acquirer, the real question is:

Is this just a solo act… or can it become a scalable business?

? What We Evaluate in Commercial Due Diligence:

1 Founder's Role vs. Business DNA

Is success completely founder-dependent, or is there a clear plan to institutionalize the model?

2 Scalability

Can the business expand beyond the founder’s personal network, bandwidth, and hustle?

3Transition Potential

Can repeatable processes, second-line leadership, and systems be built to make the business founder-independent?

4 Revenue Quality

Is there recurring revenue, diversified customer base, and operational continuity even without the founder?

5 Unit Economics

Does the business model support sustainable profitability, or is it reliant on personal relationships and negotiations?

Being founder-led today isn’t the issue.

The risk is when there’s no vision or structure to grow beyond the founder.

We’ve seen strong businesses collapse after an exit not because the idea was flawed, but because the business was never allowed to breathe on its own.

Don’t just ask “Is this a great founder?”

Ask:

“Is this a business that can thrive without them?”

Commercial due diligence helps you look beyond the pitch and evaluate the real transferability and longevity of the model.

#StartupTips #DueDiligence #InvestorReadiness #StartupFounders #Fundraising #Valuation #Governance #FinancialClarity #DueDiligenceSeries #valuationexpert #dealadvisory #ValueEdge #investments #mergersandacquisitions #privateequity #aifinvestments #mutualfundhouse #legalduediligence #compliancecheck #riskmanagement #dealmakers

Textiles & Apparel Valuation: Fashion Meets Finance Style changes fast cash flows shouldn’t.

Read More..

Absolutely. We have IBBI-Registered Valuers under all three categories—Land & Building, Plant & Machinery, and Securities/Financial Assets. Our team also includes experienced chartered accountants and engineers.

Yes. We offer remote/desk-based valuation for startups, financial assets, and select use-cases. For physical assets, we usually require on-site verification.

Yes. Client confidentiality is paramount. All data shared is stored securely and not disclosed to any third party without your consent.